Living in a “swing” state, it is no surprise to me that it’s election season. What is really remarkable, at least to me, is that by the time 2024 draws to a close more than 76 countries, representing 60% of the global population, will have had the opportunity to vote. Let’s talk about what elections do and don’t do to global markets.

Every election season stirs up speculation about market reactions. The pundits have a field day with sensational speculation about what will happen. The reality is that elections are merely one factor out of thousands including decisions of foreign leaders, disasters, innovations, and – perhaps most importantly – market demand for goods and services that can impact global markets. Many of these factors can be far more powerful than any one office holder. Elections do of course have a significant impact on our lives, especially at the local level, so please exercise your right to vote. However, historical market returns show us that elections don’t play a significant role in market fluctuations.

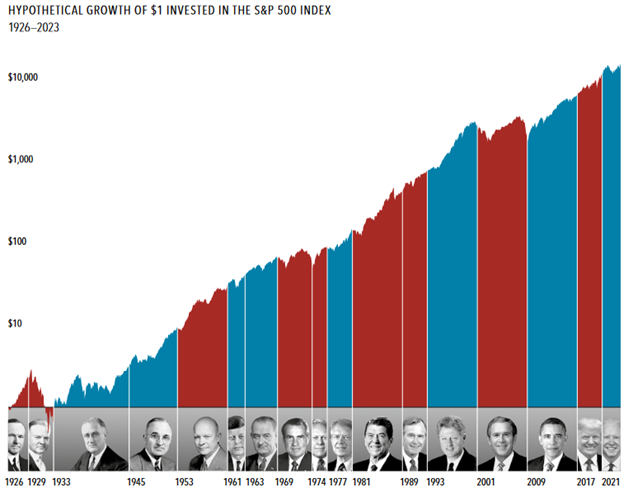

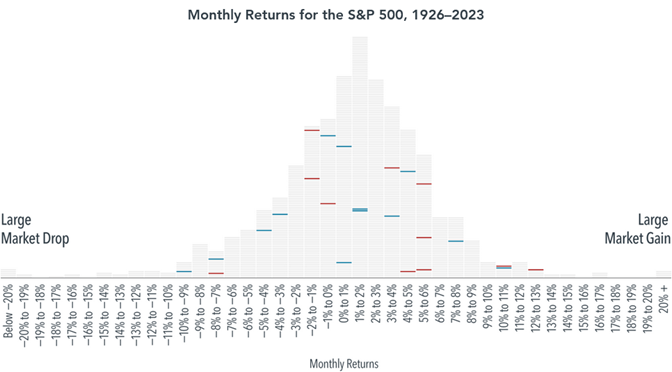

I’ve included two charts below that help to illustrate this point. The first one shows hypothetical market returns of a $1 investment by president since 1926. You’ll quickly notice markets continuously rise overall, regardless of the party in the White House. (If you’re interested, I have others showing similar results regardless of the party in control of Congress.) The second chart contains all monthly S&P 500 returns since 1926, highlighting presidential election months and the party that won. You’ll note that neither election months, nor a particular party winning the election, has been a reliable driver for the direction or magnitude of market movements.

No matter if you are pleased, angry, or apathetic in the weeks following this next election, you’ll still be shopping in the same stores, eating the same food, and spending money however you desire. This is the same behavior we will see across the world after the other elections this year. This behavior is the power of markets, and no one election can change that.

A Note on Hurricane Helene

There are no words to adequately describe what has happened to many areas of Western North Carolina. The significance of the destruction is beyond generational and incomprehensible. Many of us ‘nearby’ have already seen a remarkable outpouring of support heading to the mountains, and a true spirit of ‘helping thy neighbor’ has emerged. It is humbling to witness the power of nature. If you or anyone you know would like some help in thinking about ways to support the recovery effort(s) with your portfolio, please give me a call. Depending on the structure of your accounts and your age there may be some tax-advantaged methods to support these organizations for both the long and short-term.

Live Long and Prosper,

Dan Tobias, CFP®

Chart 1

Courtesy: Dimensional Fund Advisors LP. Past performance is not a guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. In USD. Growth of wealth shows the growth of a hypothetical investment of $1 in the securities in the S&P 500 index. S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Data presented in the growth of wealth chart is hypothetical and assumes reinvestment of income and no transaction costs or taxes. The chart is for illustrative purposes only and is not indicative of any investment.

Chart 2

Courtesy: Dimensional Fund Advisors LP. This chart shows monthly stock-market returns in 1% increments, and each dash represents a month. On the left side are the months with market declines. Months with market gains are shown on the right side. The blue and red dashes represent months during which a presidential election was held. Blue means a Democrat one the election while red means a Republican won. Most election months haven’t produced extreme returns in one direction or the other. The winning party hasn’t been a reliable driver for the direction or magnitude of market movements in election months either. Please click the graphic above to go to the source page.

This chart shows monthly stock-market returns in 1% increments, and each dash represents a month. On the left side are the months with market declines. Months with market gains are shown on the right side. The blue and red dashes represent months during which a presidential election was held. Blue means a Democrat one the election while red means a Republican won. Most election months haven’t produced extreme returns in one direction or the other. The winning party hasn’t been a reliable driver for the direction or magnitude of market movements in election months either.

Live Long and Prosper,

Dan Tobias, CFP®

Please note: The above is a copy of the 2024 Q2 Passport Wealth Management client newsletter attached to quarterly statements from July 2024. The newsletter is published to the website for informational purposes only and is not financial or investment advice. You should consult a CERTIFIED FINANCIAL PLANNER™ Professional for financial advice.

Past performance may not be indicative of future results. Indexes are not available for direct investment. Investing involves risks, including the potential for loss of principal. There is no guarantee that markets will act as they have in the past or that any investment plan or strategy will be successful.

Continue Reading

Our Affiliations: